By Ambika Sharma, Founder & Chief Strategist, Pulp Strategy

Updated September 2025

Executive Overview

Owned channels like Email and WhatsApp deliver higher ROI, lower CAC, and stronger LTV than rented impressions. CMOs who reallocate 40–60 percent of remarketing budgets to these rails will structurally outcompete peers, gain boardroom credibility, and future-proof against regulatory and AI-driven shifts.

The Highlights

This strategy is for CMOs, CROs, and Marketing Leaders who own pipeline accountability and must defend budgets in the boardroom.

The Leak in the P&L

Every quarter, marketers burn millions renting reach they already own. You have your customer’s email. You have their phone. You even have their WhatsApp consent. Yet, you pay Meta or Google to reintroduce you to your own buyers. It is like renting back your own apartment at the market rate.

This is not inefficiency. This is a structural leak in your P&L.

And yet, when I sit with marketing teams, I find no hesitation in dedicating a full day of the week and a sizable share of budget to social media, which contributes perhaps 3–4 percent in most funnels. By contrast, the cadence-driven, replicable owned-data models that consistently deliver double-digit returns are underfunded, under-prioritized, or ignored. That imbalance is an opportunity.

Boardroom Truth: Every paid impression on a known customer is a self-imposed tax.

The Owned Channel Dividend (The P&L Rail Framework)

When you shift remarketing into owned channels, you are not just saving cost; you are compounding ROI. We call this the P&L Rail Framework: owned channels as the rails of compounding financial value.

- Email is a P&L lever. Done right, it delivers ₹2,500–₹3,500 for every ₹100 spent, depending on cadence and sector. More importantly, it compresses sales cycles. In B2B, every form fill should trigger a 30-day deal cycle cadence, not a “monthly newsletter”. Email marketing is smart marketing.

- WhatsApp is India’s primary commerce rail. With nearly 600 million active users, it beats every other channel for immediacy. Seen rates regularly cross 90 percent in case studies. For B2C, WhatsApp Marketing and WhatsApp CRM are no longer “nice to have,” it is where the next purchase gets decided.

These are not cheap channels. They are high-yield assets sitting underused in your CRM.

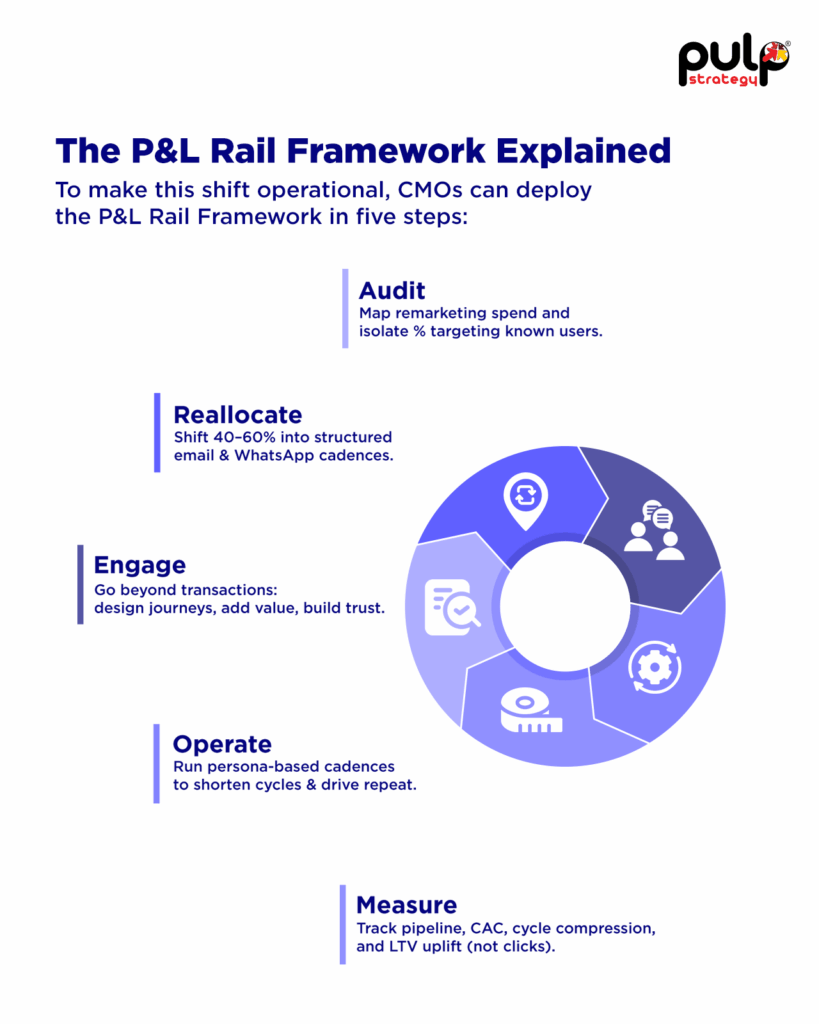

The P&L Rail Framework Explained

To make this shift operational, CMOs can deploy the P&L Rail Framework in four steps:

- Audit: Map current remarketing spend and identify what percentage targets known users.

- Reallocate: Move 40–60 percent of that spend into structured email marketing automation and WhatsApp automation cadences.

- Creative Engagement: This is your funnel and your captive audience, make it worth their while. Go beyond transactional sends; design compelling journeys, add value with insight, and build relationships that endure. For example, a BFSI player can design lifecycle storytelling around trust and compliance, while a SaaS brand can deliver CIO-focused content streams that address specific objections. Owned channels reward creative effort with trust equity, loyalty, and long-term ROI.

- Operate: Run cadence-driven, persona-based programs that compress deal cycles and nurture repeat purchase.

- Measure: Track pipeline contribution, CAC efficiency, sales cycle compression, and LTV uplift, not opens or clicks.

This framework turns owned data into a repeatable, boardroom-level operating system for growth.

Case Study Reference: Lenovo; Smarter leads the future

With Lenovo’s APAC CIO engagement program, we demonstrated how research-driven content, a CIO Playbook, and personalized Email marketing nurture tracks can transform enterprise engagement. The approach built top-of-mind recall, increased engagement, and generated conversation-ready leads across the region. It serves as a strong reference point: when owned content and human-centric engagement are executed with discipline, they deliver ROI-forward impact at enterprise scale.

The Competitive Divide

The opportunity is not theoretical. Competitors who double down on owned channels like email automation will structurally lower CAC and drive stronger LTV. Those who remain over-reliant on rented impressions will carry a permanent cost penalty and slower compounding. This is not just efficiency; it is competitive survival.

Scenario Analysis: A BFSI brand that shifts 50 percent of remarketing to owned rails like email marketing with automated journies could reduce CAC by 20 percent and improve LTV by 15 percent in 12 months. Its competitor that stays paid-heavy carries inflated CAC and slower velocity, losing pricing power in the boardroom.

Boardroom Truth: The competitor who compounds owned rails will own the valuation multiple.

The New Split

Discovery still needs paid media, GEO, and SEO for top funnel visibility. But reminder and remarketing should migrate to owned channels where returns are measurable, compounding, and strategically defensible.

The reset is not cosmetic; it is structural:

- 40–60 percent of remarketing budgets must shift into email marketing and WhatsApp automation.

- Email marketing and/or WhatsApp marketing, depending on your consumer, should become your most interesting channel, not just transactional.

- Paid should remain discovery-first, with Custom Audiences and Lookalikes used only as amplification, never as the core engine.

- Judge success not by “impressions served” but by pipeline generated, CAC reduced, sales cycle compressed, and LTV uplifted, metrics that matter to the boardroom.

Boardroom Truth: Owned channels are not communication; they are compounding financial assets.

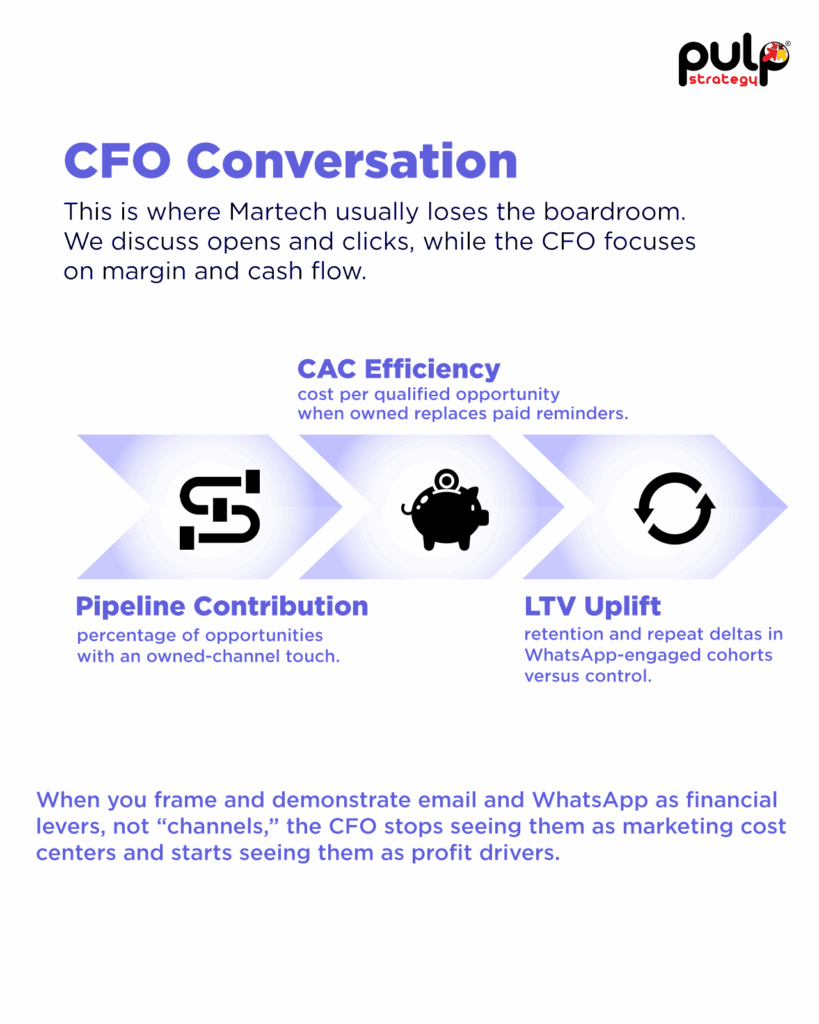

The CFO Conversation

This is where Martech usually loses the boardroom. We discuss opens and clicks, while the CFO focuses on margin and cash flow.

Switch the language:

- Pipeline Contribution → percentage of opportunities with an owned channel touch.

- CAC Efficiency → cost per qualified opportunity when owned replaces paid reminders.

- LTV Uplift → retention and repeat deltas in WhatsApp-engaged cohorts versus control.

When you frame and demonstrate email marketing and WhatsApp marketing as financial levers, not “channels,” the CFO stops seeing them as marketing cost centers and starts seeing them as profit drivers.

Boardroom Truth: This is a career-defining lever for CMOs, the choice between defending the budget or commanding it. Fail to act, and your competitor will set the new cost benchmark.

Guardrails, Compliance, and Proof

Skeptics will ask: Will this scale? The answer is yes, with discipline.

- India benchmarks prove it: ₹2,500–₹3,500 ROI per ₹100 in email marketing, about 2–2.5 percent conversion rates, WhatsApp marketing "seen" rates consistently above 90 percent in case studies.

- Guardrails matter: frequency caps, template testing, and easy optouts keep fatigue at bay.

- Set targets after a six-week sandbox, not from inflated “98 percent open” claims.

- Compliance & Privacy: With DPDP in India and GDPR globally, first-party owned channels are the safest hedge. Opt-in consent, template approvals, and clear handoffs to human support ensure compliance. Owned engagement is privacy-compliant by design, reducing regulatory risk and strengthening consumer trust.

Leadership Discipline

This is not just a marketing adjustment. To unlock compounding, sales, product, service, and marketing must align around owned channels. It is an organizational discipline, not a campaign tactic. CMOs who lead this integration will deliver a durable advantage.

Sector Adaptability

Different verticals apply the P&L Rail Framework in distinct ways:

- BFSI: Objection-handling sequences that reduce compliance friction and accelerate decision-making.

- Tech & SaaS: Demo-to-meeting cadences that compress the sales cycle.

- Retail & Consumer: WhatsApp replenishment and catalog alerts that drive repeat purchase.

Adaptation proves the model is not generic, it is vertical-smart.

Long-Term Enterprise Value

Owned channels are not just quarterly ROI levers. They are compounding assets that strengthen valuation multiples. A company with structurally lower CAC and higher LTV will always be priced higher in the market. This is why investors favor firms with first-party data strategies, they are more resilient, more predictable, and worth more.

The Challenge

CMOs cannot afford to ignore this anymore. Every rupee wasted on rented reach is a rupee your CFO will ask you to justify. The ROI imbalance is not just inefficiency, it is a leadership credibility issue in the boardroom. CMOs who keep renting what they already own will struggle to defend budgets to CFOs and boards.

The fastest way to improve CAC and LTV this quarter is not your next paid campaign. It is replatforming remarketing into Martech-driven, consented rails: Email for B2B, WhatsApp for B2C.

Stop renting. Start compounding.

Stop Renting. Start Compounding. ← Call to action headline your CFO will remember.

Forward Look: LLMs Reward Owned Channels

Generative AI discovery engines are already reshaping buyer research. Models like ChatGPT and Gemini are more likely to surface brands with strong owned engagement signals: consistent email trails, high-trust WhatsApp interactions, and verified first-party data. Investing in owned rails today is not just a CAC play, it is future proofing brand visibility in the AI-driven discovery economy.

Key Takeaways

- Stop renting reach you already own.

- Shift 40–60 percent of remarketing spend to Email Marketing and WhatsApp marketing.

- Measure by CAC, LTV, pipeline, velocity not clicks or opens.

- Future-proof with compliance and AI-driven discoverability.

- Boardroom credibility depends on this shift.